Interest Rate Swaps

Help your clients achieve rate certainty with a swap.

GETTING TO KNOW INTEREST RATE SWAPS

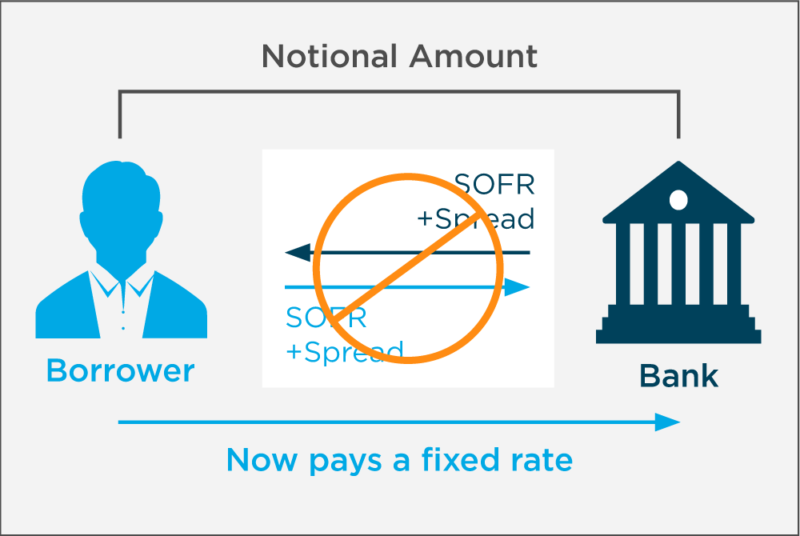

An interest rate swap is an agreement between two parties in which one agrees to pay a fixed rate of interest—and the other to pay a floating rate of interest—for an agreed-upon notional (principal) amount.

No principal changes hands. Instead, there’s simply a swapping of interest payments for a set time at a rate derived from market expectations at the time of swap execution. A floating-rate loan and an interest swap together create a “synthetic” fixed-rate loan.

HOW DO SWAPS WORK?

Let’s say a borrower has a 1-month SOFR-based loan and pays variable interest payments over the term. With a swap, the borrower executes a “pay fixed” contract at a fixed rate vs. a 1-month SOFR plus a spread. These cash flows allow the borrower to then pay a fixed rate on their loan for an agreed-upon term.

Let’s say a borrower has a 1-month SOFR-based loan and pays variable interest payments over the term. With a swap, the borrower executes a “pay fixed” contract at a fixed rate vs. a 1-month SOFR plus a spread. These cash flows allow the borrower to then pay a fixed rate on their loan for an agreed-upon term.

Our customizable swap solutions make it possible for clients to benefit from a personalized strategy that fits their unique circumstances.

Quick Facts:

- The borrower maintains a floating rate loan that works in conjunction with the swap.

- The borrower pays or receives the net of a 1-month term SOFR plus a spread and the swap rate for an agreed-upon term.

- The interest due on the loan and the net interest due on the swap equal the total interest due at the fixed rate that was locked in at swap execution.

LOCK IN RATE DEPENDABILITY

An interest rate swap is excellent for protecting against an anticipated rise in interest rates, but there are many additional advantages for your clients.

MANAGE CASH FLOW

Since your fixed payment is known once the swap rate is secured, the interest payment stabilizes. Let that certainty be the foundation for smart, strategic plans.

BILATERAL PREPAYMENT

Unlike traditional fixed rate and variable rate loans, interest rate swaps hold a value immediately upon execution. As market rates change, the swap takes on or loses value. Which means, the valuation of a borrower’s swap at any point in time could be an asset, a liability, or have no value. Only if the swap is terminated or amended prior to its maturity will the borrower either pay or receive the prepayment economics associated with the swap contract.

SECURE A FUTURE RATE

Borrowers have the ability to secure future fixed rate pricing, up to 18 months out, by executing a forward interest rate swap, thus alleviating the uncertainty of future rates.

COMPLETE A SWAP ON A PORTION OF THE LOAN

A swap doesn’t have to be completed on the entirety of the loan. A borrower can obtain an interest rate swap to secure a set rate on a portion of the loan, so they still have a floating rate for the rest. This affords more flexible and creative options for portfolios.

Additional benefits:

- Rate certainty

- Terms up to 15 years

- Customizable repayment options (interest only or amortizing)

IDEAL CANDIDATES FOR A SWAP

An interest rate swap may be the perfect option for your clients if they:

- Are seeking a financing term of three (3) years or longer potentially in support of a long-term asset(s)

- Have a current loan balance of $2 million or larger

- Qualify as an Eligible Contract Participant (ECP)1 under the Dodd-Frank Wall Street Reform and Consumer Protection Act

- Are opportunistic investors who want to take advantage of low-cost capital

- Commercial and or residential real estate investors

- Sole proprietors

- Small to medium sized private equity firms

- Individuals or companies with future liquidity events

- Benefit from a customized hedging strategy

- Expect their floating interest rates will increase over time

THE RIGHT TIME TO SWAP

Current swap rates can give borrowers the ability to hedge longer-term liabilities at a rate much lower than shorter-term liabilities. Depending on a client’s unique situation, an interest rate swap may provide valuable rate certainty. By providing a product customized to your clients’ needs, we can help:

- Give clients access to inexpensive capital

- Create a durable rate hedging strategy

- Interest rate solutions specifically tailored to client needs

PARTNERSHIP TO MEET YOUR CLIENTS’ NEEDS

We work with multiple custodial platforms and a diversified network of money center banks to get the best Capital Markets pricing and execution for your clients.

FIXED RATE TERMS UP TO 15 YEARS

We offer a wide variety of loan terms to fit your needs, from shorter/smaller term (traditional fixed rate) to longer/larger term (via swap market).

INDUSTRY EXPERTISE

Our team of experts brings decades of experience and dedication to every banking relationship, so you’ll know your clients are getting sound financial guidance.

COMPETITIVE RATE OPTIONS

Utilizing interest rate swaps allows us to provide your clients with the best rates available, ensuring they have the best financial strategy for their goals.

EASE OF DOING BUSINESS

Our simplified procedures enable quick processing and management for individuals and entities. Plus, all custodial platforms are managed under one roof.

WORKING TOGETHER TO PROVIDE SMARTER SOLUTIONS

Find out how we can help you serve your clients better.

FAQS

Get quick and clear answers to some of our most received questions about swaps.

No. Borrowers may choose to fix less than the full principal balance of their loan. For example, borrowers can lock in 50% of their loan and let the other 50% float.

The valuation of a swap at any point in time could be an asset, a liability or have no value to the customer. The customer only pays or receives breakage costs if the swap is terminated or amended prior to maturity. The swap breakage is the difference between the original swap rate and the current market replacement swap rate. In a higher rate environment, the swap becomes an asset to the party paying the ‘below market’ fixed rate. In a lower rate environment, the swap becomes a liability to the party paying the ‘above-market’ fixed rate.

TriState Capital Bank offers swap terms out to fifteen years for qualified clients.

No. TriState Capital Bank can customize your repayment structure to fit your specific needs. Swaps can follow an established amortization schedule, remain interest only, or follow a hybrid schedule combining the two options.

Interest rate hedging transactions are documented using the International Swaps and Derivatives Association (“ISDA”) Master Agreement and Schedule. The ISDA Master Agreement is an industry standard document which governs all interest rate hedging transactions. The Schedule tailors the standard documentation to the specifics of the client and references collateral types. All parties must also attest to being an Eligible Contract Participant (ECP) per the Wall Street Reform Act. All pre-trade documents are prepared by TriState Capital Bank.

1An Eligible Contract Participant (ECP) is defined in the Commodities Exchange Act as an individual or entity who meets minimum financial thresholds or conditions, generally $10 million in total assets for entities or $5 million for individuals hedging an interest rate risk, although other qualifications can be satisfied. You must certify to us how you qualify as an ECP at the time of any transaction by completing and signing our ECP certification forms.