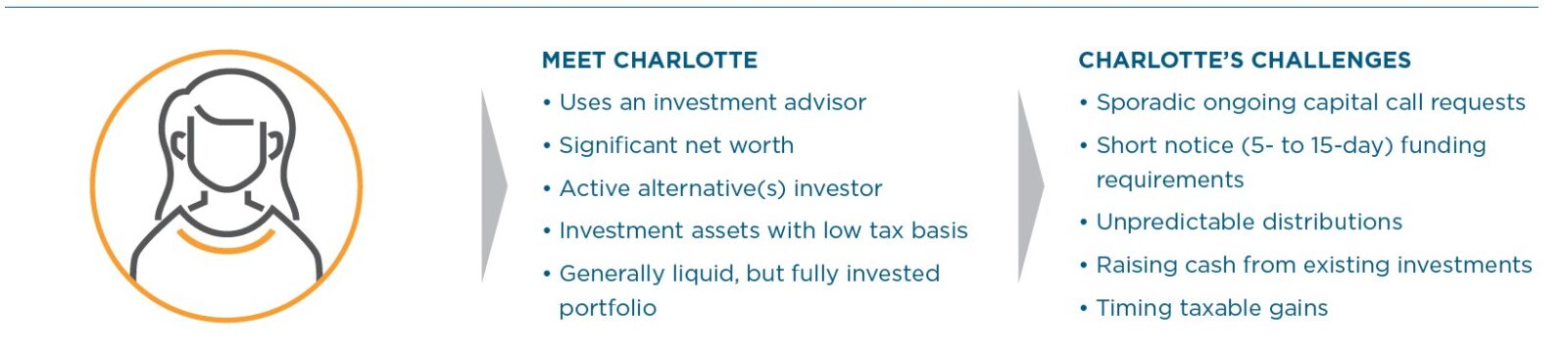

For investors in alternative investments such as hedge, private equity or real estate funds, capital commitments require an ongoing liquidity strategy to fund investments on someone else’s schedule. Even those with the most significant balance sheets want to avoid harvesting investments on short notice, which can lead to the disruption of investment strategies and tax objectives.

Proactive Cash Planning

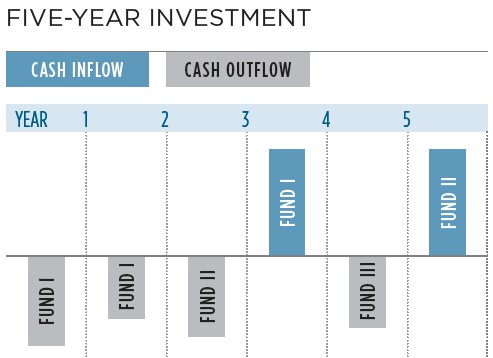

Charlotte made two capital commitments in year one, the first to a special situations fund, and the second to a real estate mezzanine finance fund. Shortly thereafter, the first of multiple capital calls are requested by the fund sponsor. Throughout this time frame she must maintain a liquidity cushion in order to ensure adequate cash to meet the next call, although she would like to stay invested in her core portfolio. Instead of selling off assets, Charlotte has established a plan for liquidity that provides the cash she needs, while also maintaining her liquid investment portfolio.

Maintaining a Full Investment Strategy

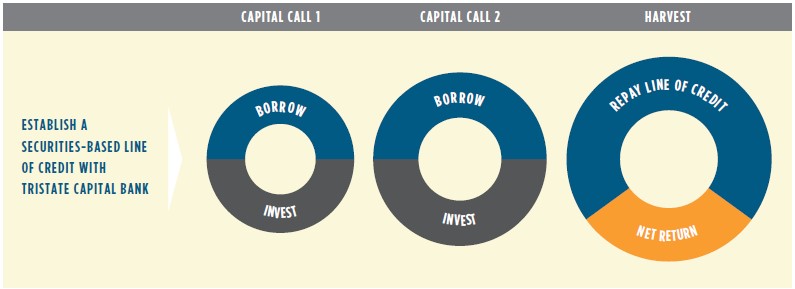

By utilizing a securities-based line of credit from TriState Capital, private equity investors can have access to considerable amounts of liquidity without derailing their carefully crafted investment strategy.

- a) Create cash capacity to plan for future capital calls and invest at the same time.

b) Draw as needed with no fees; repay with no maturity dates; and pay interest only on what is used.

c) Utilize a streamlined process and robust lending platform that enables a quick delivery through an exceptional and secure digital experience.

d) Maintain a conservative approach to borrowing and provide peace of mind that capital call(s) can be met, whenever they come in.

e) Resolve short-term liquidity needs by borrowing eligible securities without using assets.

f) Enjoy the flexibility of using multiple portfolios as collateral, with individuals, entities and trusts all eligible to borrow and pledge.

g) Choose a floating rate line of credit with the flexibility to swap to fixed rate.

“ It’s a safety net that allows our clients to commit to a long-term alternatives plan and know that they have the ability to meet a capital call whenever it comes in without altering their overall investment portfolio or creating any unplanned tax consequences.”

President, multi-family office services organization

Keeping Cash Invested Over Time

A TriState Capital Bank securities-based line of credit (SBLOC) allows investors to establish borrowing capacity at the onset of a fund commitment, secured by non-retirement liquid assets. As capital calls occur, the line can be drawn on quickly to meet capital calls while continuously maintaining the balance until a liquidity event or paydown is desired.

Find Your Banker

We believe banking is personal. It’s about relationships and exceptional people working together. To search for dedicated bankers specific to your banking needs, industry, and location visit below.